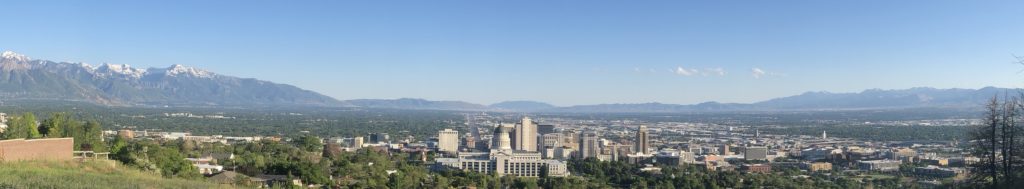

I sat down with Adam Fortuna from Minafi in Salt Lake City at a local brewery while I was in Utah on the #MoneyProTour. We grabbed a couple beers, and since we’re both passionate about Financial Wellness, we obviously hit it off right away.

Adam shared some great lessons learned from his life experiences and professional journey. On his website, he strongly preaches “reaching financial independence early through investing, minimalism, and mindfulness.”

In this specific blog article, you’ll read some examples of what went well for him on his journey… and well, some things that didn’t.

Having The Skills That Pay The Bills

Adam studied and learned Computer Programming, and put that skill to work as he built his professional career. Working on websites has been in high demand for decades, and Adam had no problem finding work with his skills and experience. As he puts it: he had no problem with being “gainfully employed.” He took advantage of an opportunity to work with a Start Up Company alongside some friends slash business contacts he knew, and the team built up the company from the ground up.

At a time when “so many people are just trying to get to zero (from being in the negative)” Adam took great pride to work hard to build into the positive and make smart financial decisions.

Through the Great Recession of 2008, the company downsized its staff. They went from about 50 employees down to 20 employees. It was a stressful time, but Adam survived the downsizing and kept his job. At the end of this article, you’ll hear about what that has meant for Adam in 2018, 2019, and beyond.

Tragedy and Triumph

Adam opened up to me and shared more about his childhood, family, and growing up. He told me that his mother had passed away while he was in college, leaving him about $100,000. Adam wasn’t just going to shit that money away.

Initially, he said, “I went to an advisor who put me into 5% front-end-load mutual funds, in addition to other management fees by the advisor.” Adam was looking for guidance and was unsure of what to do on his own.

Then he quickly became unhappy with the fee structure of his investments. He learned more about how he could manage his own funds and investments without paying those kind of fees, and without sacrificing solid investment holdings.

He continued to save aggressively, setting aside up to 50% of his earned income, and after about half a decade he was up to around $1,000,000 of investable assets. He continues to manage his assets on his own, utilizing a fairly simplified number of ETFs / Index Funds. Diversified and low cost.

When Buying Real Estate …(bum bum bum)… GOES WRONG!

Homeownership isn’t always as simple as being a first-time-homebuyer, finding your dream home, and everything going according to plan. Surprise, surprise. There are huge economic factors at play that you don’t have any control over – yet they seriously affect your financial success. Here’s an example to learn from.

What happened?

In Orlando in 2007, Adam bought a home with 20% down payment for around $290,000, which meant about $60,000 Down Payment and a Mortgage of around $230,000 total. He was 24 years old and working full time in his career as a computer programmer at the Start Up.

No red flags at that point – a hard working American working full-time and putting a substantial amount down up front. Within their budget. Safe and conservative. Then the Great Recession hit.

The Housing Crisis of 2008 caused the value of Adam’s home to plummet to as low as $140,000 just about 2-3 years later. He was stuck ‘underwater’ on his primary residence – meaning the balance that he owed to the bank (mortgage) was significantly higher than value of his home. While the government provided programs to assist homebuyers who were screwed in this way, Adam ‘made too much income’ to qualify for federal assistance programs.

It took a decade to rebound from this situation. More than 10 years after buying his home, Adam was able to finally sell for just even money – about the same value that he bought the home for 10 years earlier. Adam now lives in Salt Lake City with his wife and they are renting – with a smile on their faces! They are not too worried about the fact that they don’t currently own real estate. Especially after the decade of ownership in Orlando, they’re hesitant to get back into real estate ownership.

The big takeaway from this Real Estate experience is the importance of CASH FLOW. For example, since the mortgage is fixed, the monthly payment remains steady for the homeowner as the years go by. Let’s assume that Adam’s Orlando home cost a total of $1,700 per month in all-in expenses. If he could have rented out the property for $2,000 per month (CASH FLOW!) this would have allowed him the freedom to move out of the property, allow a tenant to pay down the property on his behalf, perhaps have a little positive cash flow coming in each month, and not feel ‘stuck’ in the home.

Living On FI/RE

Adam shared some really cool news with me about his Start Up. Thanks to the hard work that went into building up the company, and the equity that Adam built up in the company itself as it grew, Adam was able to WIN BIG. He left his job in December 2018 with a cash-out-windfall on his company stock. This meant his investment account grew to enough millions that Adam is able to live within his means off of just the interest from his Brokerage Account.

His wife is still employed, working full-time, and the employer provides the valuable benefit of Family Health Insurance to cover them both.

“I enjoy writing weekly for my blog,” Adam shared with me as we enjoyed our beers. We reflected together over both his “money journey” and my journey on the #MoneyProTour.

We laughed over reflecting on the evolution of money over these past 50 years.

From the Hippies’ “Peace & Love” of the 1960’s and 1970’s…

…to the Alex P. Keaton “Family Ties Stockbroker” of the early 1980’s….

…multiplied by Gordon Gekko’s “Greed is Good” Speech in Wall Street…

… sprinkling in Lifestyle’s of the Rich & Famous “Champagne Wishes & Caviar Dreams”…

… culminating in the 2000’s and Super Sweet 16 spoiled brats and MTV Cribs showoffs…

“Champagne Wishes and Caviar Dreams”

– Robin Leach, TV Host

.. to where we find ourselves today.

We as a generation, we as a people, have realized that spending money and “greed” from the wrong reason can lead to a HUGE lack of fulfillment.

Adam is a big believer in minimalism and mindfulness. This means filling your life with the things that bring you the most joy, and eliminating the unnecessary minutia. This is especially true, from his perspective, for folks to do the same with their Personal Finances.

Following that path of The Adams and The Dimitrys of the world will show you how to value your time and freedom and want to fill your life with the things that bring the most value and happiness.

What stood out to you the most in this article?

Comment below and tell me what caught your eye the most.