Dimitry Neyshtadt ChFC is an award-winning Financial Advisor who left behind his “office life” to spend 2019 traveling 25 States in 25 Weeks on the #moneyprotour. Make sure to follow along on Instagram and Youtube!

I left Virginia on the Money Pro Tour and rolled into North Carolina. The weather was perfect, and the rolling green hills seemed to go on forever.

As I crossed the state border, I remember distinctly pulling off by a wide river to walk my french bulldog Brady – @thefinancefrenchie. There were half a dozen people fishing on a dock, and the view was picturesque. It was a calm scene, much different than the scene I would find in the state’s capital city – Raleigh – just a day later.

Marching Alongside Teachers in Raleigh

I had never heard of the #RedForEd movement before running into tens of thousands of teachers marching in Raleigh. They were marching for a few key reasons.

- Living Wages for Teachers and School Employees -every teacher we spoke with had at least one additional side-hustle because they need more income, such as bartending, tutoring, driving for Uber, etc.

- Adequate School Supplies Provided by the School -every teacher we spoke with had paid out of their own pocket for school supplies throughout the entire school year.

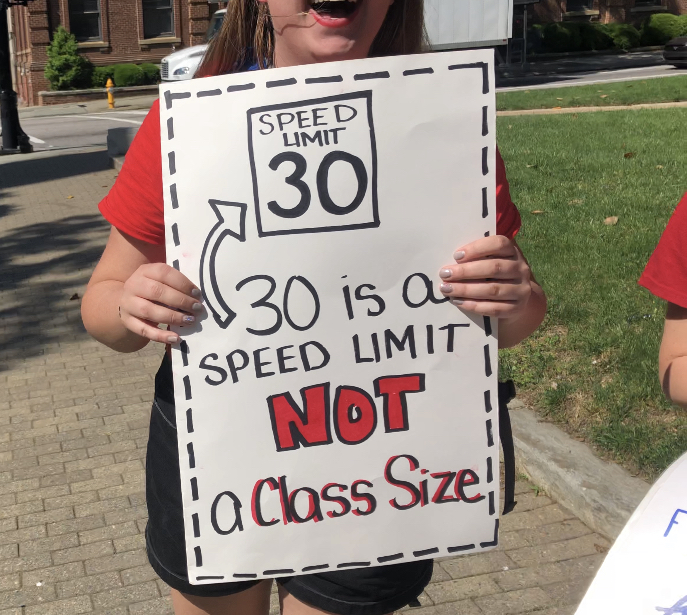

- Smaller Class Sizes -teachers cited classes up to 30 Students per 1 teacher

- Provide enough school librarians, psychologists, social workers, counselors, nurses, and other health professionals to meet national standards

- State Elected Officials to Support Teachers -teachers have felt underrepresented and marched to speak with senators and other top officials to

Let’s hear from two teachers in particular who we met up with after the rally at a local arcade bar. The temperature that day got well above 90 degrees, so I totally didn’t blame them for wanting to grab some beers after the march.

Read up on this incredible organization and support teachers here as they fight for the rights of students nationwide.

Dog Park Conversations in Charlotte

At an awesome dog park in Charlotte, we ran into a really cool gal named Catherine. She really opened up to us about her career journey and how she and her husband feel about personal finances. We chatted for about half an hour, and recorded a video you’ll see below.

“When I went for my Master’s degree, I knew I was going to graduate with a lot of loans,” she told me. “Income Based Repayment is a Godsend.”

Being able to understand and comprehend the fact that her student loans are being charged relatively-low interest rates that are fixed, Catherine and her husband Adam have been able to build assets efficiently. They deposit money regularly into both their Retirement Plans at work and into savings and investments.

Recently, Adam was surprisingly let go from his job. His employer’s new ownership eliminated all five sales offices and there wasn’t a job available for Adam. He went multiple months without a paycheck.

Watch the video below and listen to what Catherine has to say about the situation looking back on it. Pay attention to how they would have felt if they had been overpaying the student loans aggressively, rather than paying them slowly and in a balanced approach.

Chatting with Grad School Gals in Wrightsville Beach

Student Loans can stress out a ton of people. The media definitely does it’s job by making a huge deal about the challenge that this forces upon young Americans.

But are Student Loans really toxic? Compared to credit card debt, the answer is definitely “No.” Student Loans charge about 1/3rd of the interest that credit cards charge you, and with programs such as Income Based Repayment and other refinance and consolidation options, student debt needs to be understood.

Watch this video below to see how these two graduate school students in Wilmington North Carolina reacted to learning how to #BeAMoneyPro.

#MoneyProHabit — To make the MOST of your income, you should actually be OK with paying JUST the minimum on loans that don’t charge you high interest.

This may seem counter intuitive. “Are you telling me to pay back my loans slowly, Dimitry?” Well, Yes and No. The goal is to take any dollars that you “would have used” to over-pay the loans, and ADD that amount to how much you’re currently saving already.

This is a technique known as “reallocating cash flow” into asset building. When folks like Catherine in Charlotte or the Two Gals in Wilmington, there was a theme that continued to ring true. It was even echoed by the teachers – for whom every single dollar they earn in their income needs to be optimized and not wasted.

Cash Flow Management means making sure that you’re optimally allocating the money that you make into 3 Categories – Saving, Bill Pay, and Spending. More about this is available from my courses – link coming soon. Pre-registration link will be added HERE.

For more on paying back student loans like a #MoneyPro watch this video: